NY DTF FT-970 2011-2024 free printable template

Show details

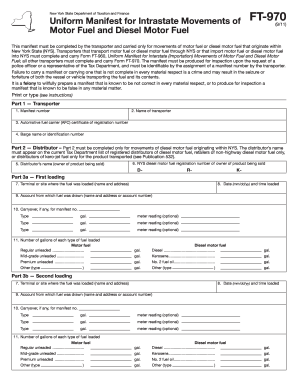

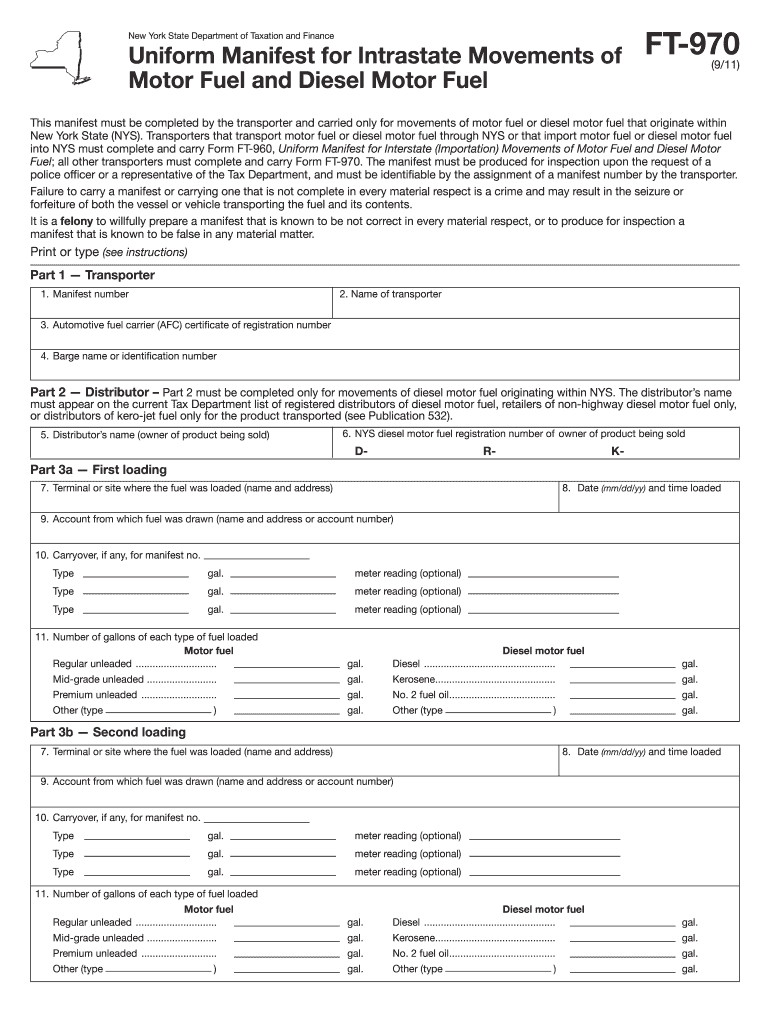

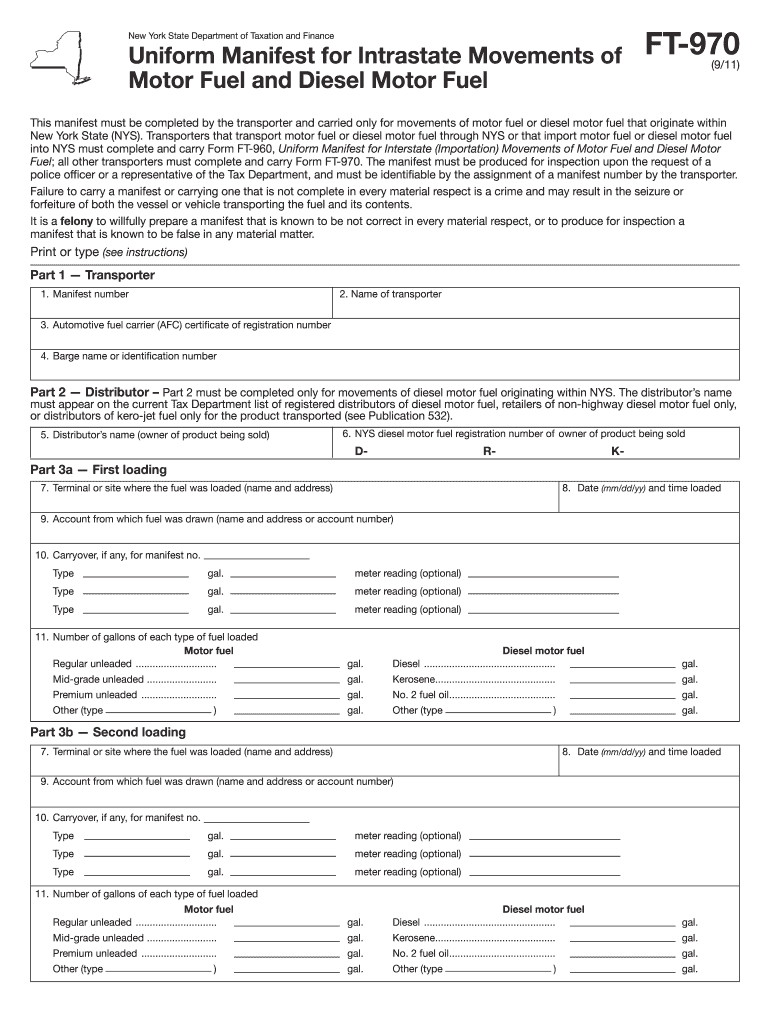

Part 3b Second loading Page 2 of 2 FT-970 9/11 Part 4 Off-loading Delivery points where fuel is to be off-loaded Complete line 12A below for each delivery. New York State Department of Taxation and Finance Uniform Manifest for Intrastate Movements of Motor Fuel and Diesel Motor Fuel FT-970 9/11 This manifest must be completed by the transporter and carried only for movements of motor fuel or diesel motor fuel that originate within New York State NYS. Transporters that transport motor fuel...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ft 970 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ft 970 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ft 970 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form ft 970. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

How to fill out ft 970 form

How to fill out ft 970?

01

Start by entering your personal information, including your name, address, and contact details.

02

Next, provide details about your employment status, such as your job title, employer's name, and length of employment.

03

Fill in the necessary information related to your income, such as your monthly salary, any additional sources of income, and any deductions or allowances.

04

Indicate if you are married and provide details about your spouse, including their name, occupation, and income.

05

Proceed to provide information about your dependents, including their names, dates of birth, and relationship to you.

06

If applicable, provide details about any investments, assets, or other financial information as required.

07

Double-check all the information you have provided to ensure accuracy and completeness.

08

Sign and date the form to complete the filling process.

Who needs ft 970?

01

Individuals who are employed and need to provide their financial information for various purposes, such as applying for loans or mortgages.

02

Employers may require their employees to fill out this form as part of their HR or payroll procedures.

03

Financial institutions or government agencies may request individuals to fill out ft 970 for verification purposes or when assessing eligibility for certain programs or services.

04

Anyone who wants to track and document their own financial information in a systematic and organized manner.

Video instructions and help with filling out and completing ft 970

Instructions and Help about nygovform ft 970

Fill ft 970 manifest : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ft 970?

Ft 970 is a type of frequency used in radio communication. It is a frequency of 970 kHz, which is a very low frequency (VLF) on the radio spectrum.

Who is required to file ft 970?

Form 990-T is generally required to be filed by any organization that has taxable income, such as an organization that is exempt from income tax under Internal Revenue Code Section 501(c)(3). Individuals who have income from activities such as rental property, a business, or a trust may also have to file Form 990-T.

What information must be reported on ft 970?

The Form 990 is the Internal Revenue Service (IRS) form used by tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations to provide the IRS with the information necessary to determine their compliance with applicable tax laws. The Form 990 is divided into six distinct sections:

1. Summary - summarizes the organization's financial information.

2. Program Service Accomplishments - outlines the organization's program activities and accomplishments.

3. Financial Statements - includes balance sheets, income statements, and other financial statements.

4. Functional Expenses - breaks down the organization's expenses by function.

5. Governance, Management, and Disclosure - provides information about the organization's governance, management, and disclosure practices.

6. Compensation of Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees - provides information about the organization's compensation practices.

How to fill out ft 970?

The form FT 970, also known as the Foreign Earned Income Exclusion, is used by U.S. citizens or residents to claim the exclusion of foreign earned income from their taxable income. Here are the steps to fill out the form:

1. Download the form: Obtain a copy of the FT 970 form from the official website of the IRS (Internal Revenue Service) or use a trusted tax software program.

2. Personal information: Start by entering your name, social security number, and mailing address in the appropriate sections at the top of the form.

3. Qualifying period: Indicate the beginning and end dates (month/year) for the qualifying period during which you want to claim the foreign earned income exclusion.

4. Exclusion amount: Calculate the amount of your foreign earned income that you wish to exclude from your taxable income. This exclusion limit may change each year, so refer to the current instructions provided by the IRS for the applicable year. Enter the exclusion amount in the relevant section of the form.

5. Foreign housing cost amount: If you wish to claim the foreign housing cost amount, calculate it based on the specific guidelines mentioned in the IRS instructions. Enter the amount in the appropriate field on the form.

6. Signature: Sign and date the form at the bottom to certify that the information provided is accurate and complete.

7. Attachments: Review the instructions and determine if any additional supporting documents or attachments are required to be included with the form. This may include documentation related to foreign residency, income, or housing costs. Make sure to include them as needed.

8. Filing: Keep a copy of the filled-out form and any attachments for your records. Prepare and file your tax return along with the FT 970 form, either by mailing it to the IRS or through an electronic filing method if applicable.

Note: It is recommended to consult a tax professional or refer to the IRS instructions for detailed guidance specific to your situation or any recent updates.

What is the purpose of ft 970?

FT 970 refers to the Financial Times 970, which is a financial certificate program offered by the Financial Times and London Business School. Its purpose is to provide participants with a comprehensive understanding of financial analysis, valuation methodology, and investment decision-making. The program aims to enhance participants' skills and knowledge in financial analysis and make them proficient in various financial techniques and tools.

When is the deadline to file ft 970 in 2023?

The deadline to file form FT 970 in 2023 is typically April 18th, as the tax-filing deadline is usually April 15th, but it may be extended if that date falls on a weekend or holiday. It's advisable to check with the Internal Revenue Service (IRS) or a tax professional to confirm the specific deadline for a given year.

What is the penalty for the late filing of ft 970?

Form FT-970, also known as the Application for Extension of Time to File Massachusetts Corporate Excise Tax Return, allows corporations to request an extension to file their tax return. Failure to file this form on time may result in penalty and interest charges. According to the Massachusetts Department of Revenue's penalty and interest page for corporate excise tax, the penalty rate for late filing is 0.5% per month or part of a month, up to a maximum of 25% of the unpaid tax. Interest is also charged on the unpaid tax balance at a rate of 6% per year, compounded daily. It is important to note that penalties and interest amounts may vary, so it is recommended to consult the official Massachusetts Department of Revenue resources or a tax professional for the most accurate and up-to-date information.

Can I create an eSignature for the ft 970 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your form ft 970 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit how to form ft 970 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing ft970.

How do I edit declaration nys on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute new york state ft 970 form from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your ft 970 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Form Ft 970 is not the form you're looking for?Search for another form here.

Keywords relevant to ny ft 970 form

Related to 970 ft

If you believe that this page should be taken down, please follow our DMCA take down process

here

.